The company is expected to report EPS of $1.59, down 57.49% from the prior-year quarter. Wall Street will be looking for positivity from Advance Auto Parts as it approaches its next earnings report date. In that same time, the Retail-Wholesale sector gained 3.9%, while the S&P 500 gained 4.86%. Elsewhere, the Dow gained 0.08%, while the tech-heavy Nasdaq added 0.61%.Ĭoming into today, shares of the auto parts retailer had gained 8.13% in the past month. This change lagged the S&P 500's daily gain of 0.28%.

#Splunk stock zacks free#

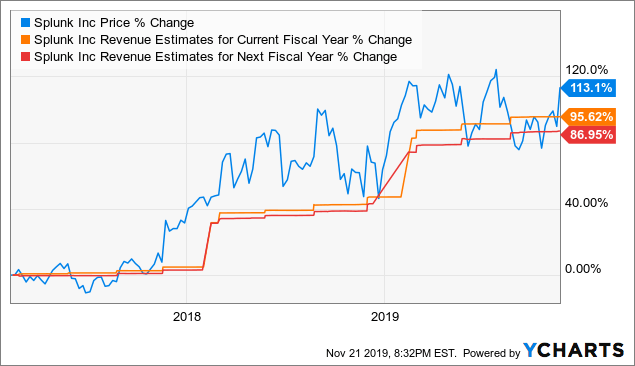

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #2 (Buy) for Splunk.Advance Auto Parts ( AAP Quick Quote AAP - Free Report) closed the most recent trading day at $71.55, moving -1.66% from the previous trading session. Looking at the earnings estimate revisions for Splunk, the Zacks Consensus Estimate for the current year has increased 23.4% over the past month to $1.80.Īnalysts' growing optimism over the company's earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

But, since brokerage analysts keep revising their earnings estimates to account for a company's changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements. The ABR is not necessarily up-to-date when you look at it. In other words, at all times, this tool maintains a balance among the five ranks it assigns.Īnother key difference between the ABR and Zacks Rank is freshness. And empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.įurthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. On the other hand, earnings estimate revisions are at the core of the Zacks Rank. Because of their employers' vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them. It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. It is displayed in whole numbers - 1 to 5. In contrast, the Zacks Rank is a quantitative model allowing investors to harness the power of earnings estimate revisions. The ABR is calculated solely based on brokerage recommendations and is typically displayed with decimals (example: 1.28). In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures. So, validating the Zacks Rank with ABR could go a long way in making a profitable investment decision.ĪBR Should Not Be Confused With Zacks Rank With an impressive externally audited track record, our proprietary stock rating tool, the Zacks Rank, which classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), is a reliable indicator of a stock's near -term price performance. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements. This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock's future price movement.

According to our research, brokerage firms assign five "Strong Buy" recommendations for every "Strong Sell" recommendation. Several studies have shown limited to no success of brokerage recommendations in guiding investors to pick stocks with the best price increase potential.ĭo you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. While the ABR calls for buying Splunk, it may not be wise to make an investment decision solely based on this information. Strong Buy and Buy respectively account for 53.3% and 6.7% of all recommendations.Ĭheck price target & stock forecast for Splunk here> Of the 30 recommendations that derive the current ABR, 16 are Strong Buy and two are Buy. An ABR of 1.87 approximates between Strong Buy and Buy. Splunk currently has an average brokerage recommendation (ABR) of 1.87, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 30 brokerage firms.

0 kommentar(er)

0 kommentar(er)